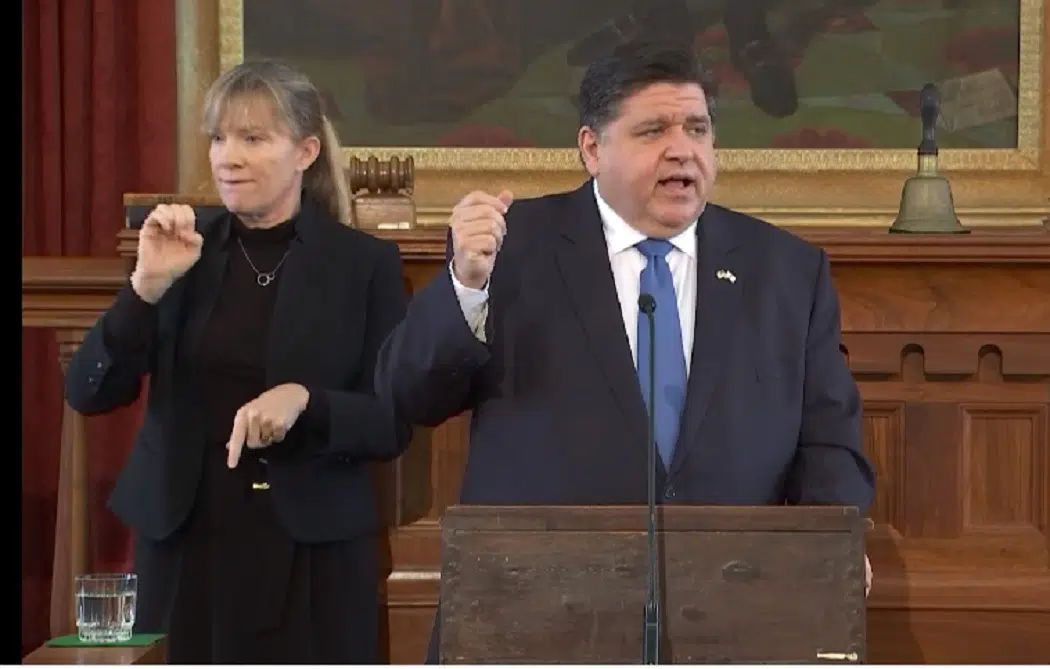

Governor JB Pritzker’s robust budget proposal for the next fiscal year aims to provide tax relief to Illinoisans and solidify the state’s financial footing.

The Governor is proposing the Illinois Family Relief Plan, suspending the state gas tax as well as the sales tax on groceries for one year and doubling the property tax deduction for homeowners.

Governor Pritzker says this is possible in part because the state is ending this fiscal year with a $1.7-billion dollar surplus.

“We start from a place where our bills are paid, our most pressing short-term debts are nearly gone and our most critical long-term liabilities are in the best fiscal shape they have been in since the turn of the century.”

Governor Pritzker’s budget plan includes a $350-million dollar increase for evidence-based funding for schools, $96-million more for transportation and special education, and $54-million for early childhood education. A $140-million increase would go to mental health care providers through rate enhancements. $900-million would be added to the state’s rainy day fund.

The budget also supports the hiring of more workers at the Department of Children and Family Services and 300 new state troopers with three Cadet classes planned for the fiscal year.

Pritzker is also requesting an additional $500-million be placed directly into the Pension Stabilization Fund.

“If approved by the General Assembly, this will be the first time since the beginning of 1994’s pension funding wrap that will reduce our pension debt for more than our required contribution. I’m asking Democrats and Republicans to work together with me to get this done because it will save taxpayers $1.8-billion dollars in interest payments over the coming years.”

The Governor’s Budget proposal also suspends state licensure fees for 470,000 frontline health care workers as well as licensing fees for bars and restaurants for one year.

The budget would eliminate the $898-million owed for employee health insurance.