$50M tax credit program will provide up to roughly $300 for low-income families

By ANDREW ADAMS

Capitol News Illinois

aadams@capitolnewsillinois.com

In the final hours of their spring legislative session, Illinois lawmakers approved a tax credit of up to about $300 for families with young children.

The credit is available to Illinoisans with children under age 12 who qualify for the federal Earned Income Tax Credit, or EITC. Although it has exceptions, that credit is generally available to married couples earning up to about $60,000 and single people earning up to about $50,000, depending on the number of children they have.

For taxes on 2024 income, the tax credit will cap at just over $300 for tax filers with three or more children who meet certain income requirements. Taxpayers with two children face a cap of about $270 and taxpayers with one child face a cap of about $170.

The child tax credit equates to 20 percent of the state’s EITC, which allows Illinois taxpayers a credit equal to 20 percent of the federal EITC.

Starting in tax year 2025, the state’s child tax credit will double to 40 percent of the state EITC, meaning that it will max out at a bit over $600 for families with three children. Because the federal tax credit that determines its size is tied to inflation, the actual size of future years’ child tax credits is yet to be determined.

In its first year, the program is expected to cost the state $50 million, with a cost of about $100 million in subsequent years.

The idea of a permanent child tax credit in Illinois has been floated for several years, with various proposals being put forward by legislators in the General Assembly as well as advocacy groups and think tanks.

Gov. JB Pritzker pitched a child tax credit in his proposed budget earlier this year that was smaller than the version that passed in the final budget. It would have applied to children under three years old and cost about $12 million.

Proponents of the idea say that in addition to helping low-income families, programs like this help local economies.

“Every dollar we invest in the child tax credit is immediately spent locally,” Erion Malasi, the policy director for Economic Security for Illinois, told Capitol News Illinois.

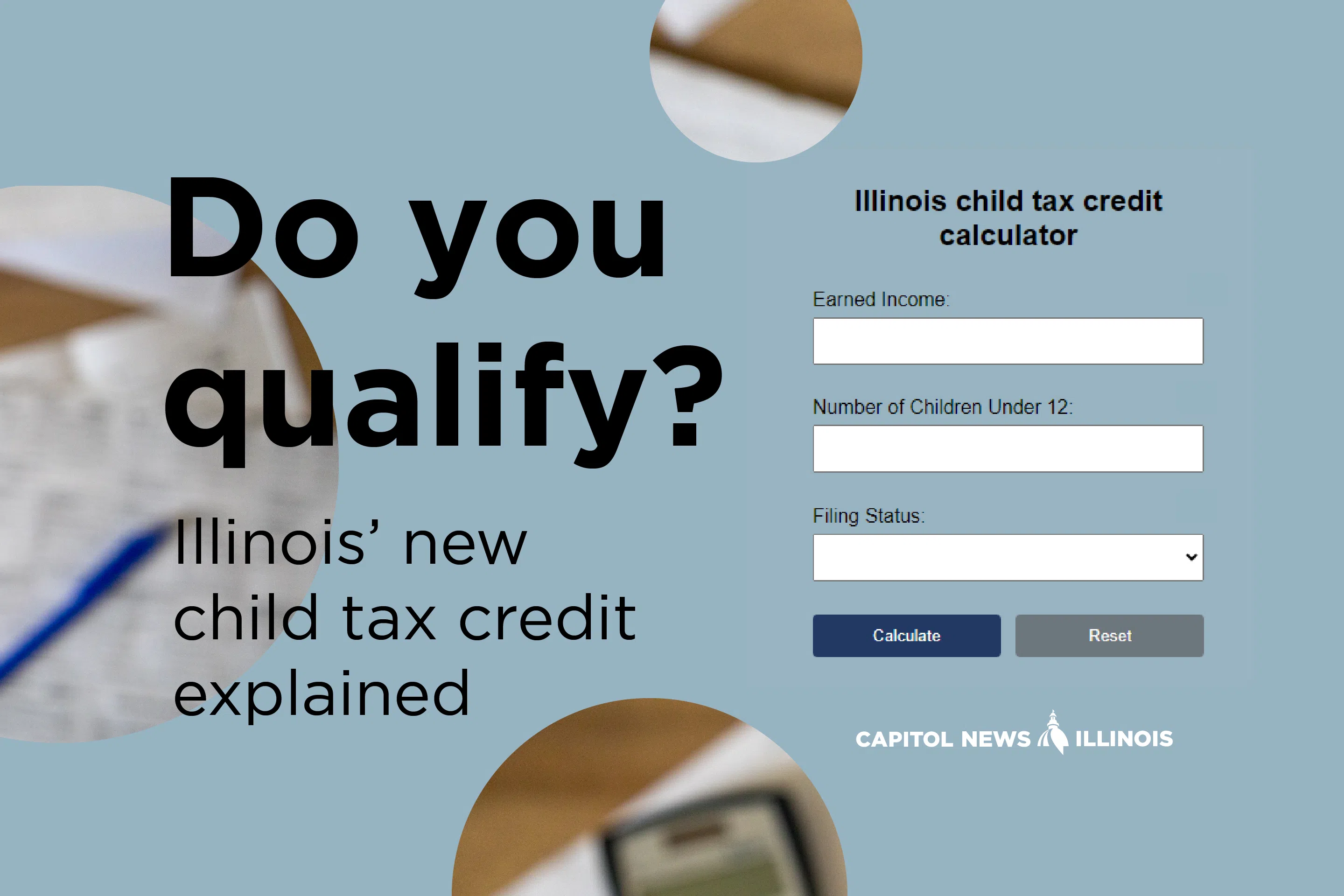

Illinois child tax credit calculator

Researchers at the Illinois Economic Policy Institute, a labor movement-affiliated think tank, found in a January report that child tax credits have a higher economic impact than cuts to corporate income taxes or to capital gains taxes.

That report also cited several research teams that found the temporary expansion to the federal child tax credit between 2021 and 2023 reduced child poverty in the U.S. by between 25 and 36 percent. That credit provided an additional $1,000 per child on top of an existing $2,000 credit, with increases for younger children.

State Sen. Omar Aquino, D-Chicago, sponsored legislation that would have created a $300 million child tax credit program that was more expansive than the version that passed.

Aquino told Capitol News Illinois he will be watching the rollout of the child tax credit to see if there is room for an “expansion” in future budget years or if there is a route for the credit to be automatically applied for qualifying taxpayers.

The Illinois Department of Revenue is working on guidance for next year’s filing season and will provide information about how to claim the child tax credit on its website.

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government. It is distributed to hundreds of print and broadcast outlets statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation, along with major contributions from the Illinois Broadcasters Foundation and Southern Illinois Editorial Association.