Story by Austin Williams

There was an unusually high turnout for the Salem Grade School Board meeting on Monday night. The board held a Truth in Taxation hearing ahead of approving the 2023 tax levy in its regular meeting. The final number the board settled on for the tax levy was 4.99%, less than the previously proposed 6.16%. A small crowd of Salem residents in attendance expressed frustration with the school board’s high property taxes, while the board replied that the blame was being misdirected, in part due to confusion over how the Illinois property tax system works. The board presented numbers and made the case that while the annual tax levy represents a small portion of the overall tax burden of Salem property holders, it is essential for the future financial well-being of the school district.

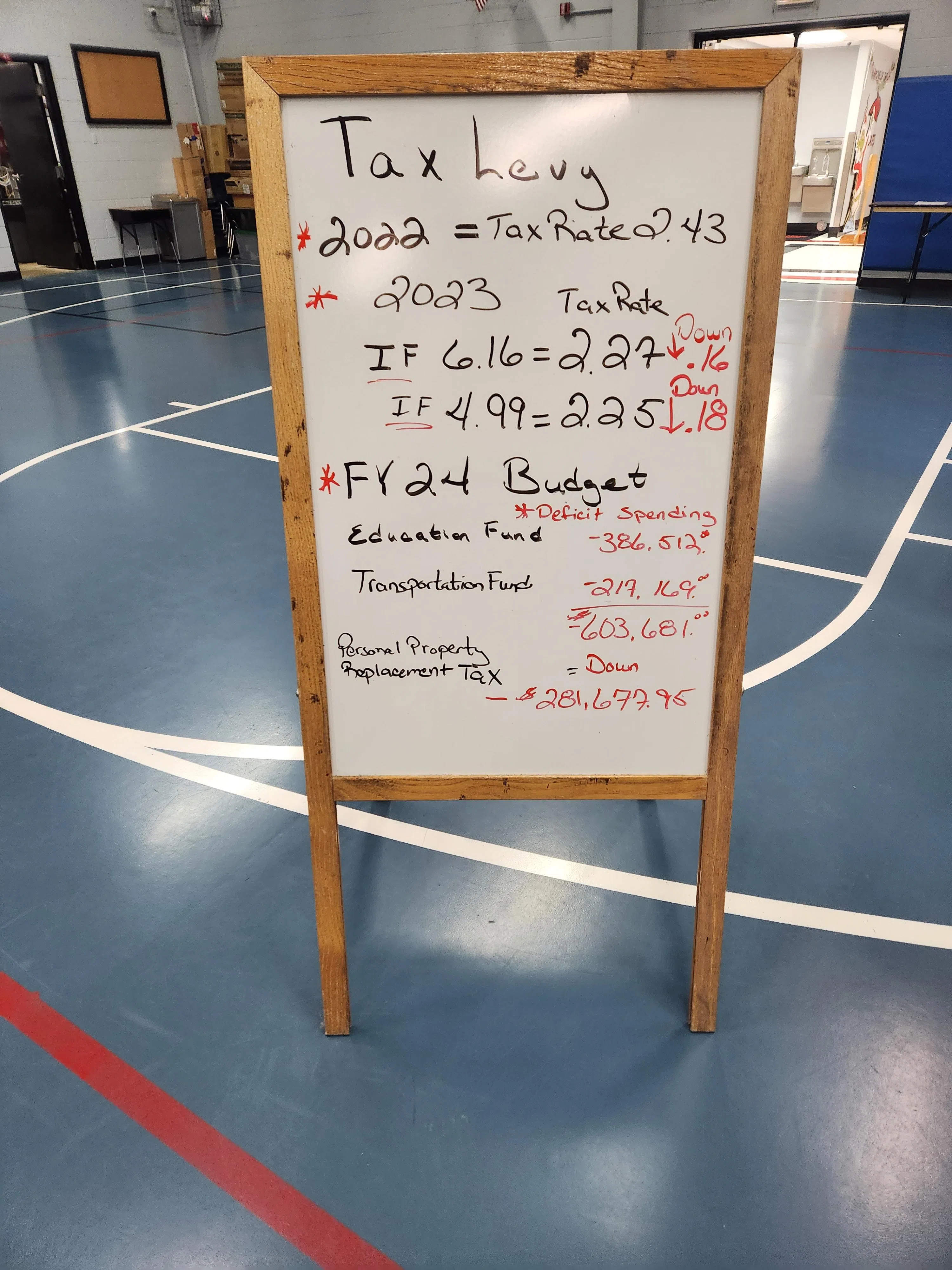

The board emphasized two points: first, the difference in the final tax rate between a greater and lesser tax levy from the district would be less than a tenth of one percent, overall. According to the numbers the board had on display, the 6.16 tax levy would have resulted in a 2.27% tax rate. The 4.99, which was approved, results in a 2.25% tax rate. To take an even smaller levy, members said, would have a limited effect on the taxpayer, who would still face a tax rate of around 2.2%. Therefore, even if it were to take no levy, the district could not provide substantial tax relief.

The second point was that in either levy scenario, the actual tax rate would be a decrease from that of the previous year. According to the board’s presentation, the 2022 tax rate was 2.43%. The projected 2.25% tax rate is therefore a reduction by 0.18%. This does not guarantee that any particular property holder will see a reduction in taxes paid; property tax is applied based on the estimated value of a given property, which is calculated according to an assessment made by the county. However, the tax rate, as a percentage applied against the assessed value of a property, is lower than it was last year.

The school district, while currently financially stable, is not affluent. The FY24 Budget is running a $600,000 deficit and will dip into the district’s cash reserves. Members of the board agreed that collecting the annual tax levy was an important part of having enough money to provide essential resources to students, both now and in the future, due to the compounding effect that forgoing a levy can have on a district’s revenue over time.

Members of the public who had complaints about the levy accused the board of spending beyond the district’s needs, providing teachers and students with resources they could do without. One man said, “We have excellent people that are God-given to teach these children, and I guarantee that we are not challenging them in some of the ways that they could be challenged… we have to start asking about what are needs vs. wants.”

The board replied that they have not entertained cutting school programs to save costs, because despite what an aggrieved taxpayer might suggest, there were no frivolous programs on the budget, and teachers weren’t flush with more cash from the district than they knew what to do with. Rather, teachers sometimes have to pay out of pocket to provide for their students. Board member Lynette Dye said, “If you brought every teacher in here, there’s not going to be one of them that a large part of their salary hasn’t gone back into their kids… I’m sitting here myself trying to think of what programs we could possibly cut. If we start cutting our athletics, our music, our art, we have kids that that’s what they come to school for. That’s why they’re here… To say we have teachers that will cut things, these teachers are putting their money into the classrooms, for those kids.”

Superintendent Leslie Foppe expanded on the importance of the school providing for kids in need: “We have sixty percent low (income) kids… not all families can afford those types of things that they need for their disabilities or issues that they’re dealing with… School is one of the most stable places that they have. They come in here and they’re happy, and we feed them and take care of them and love them and give them what they need.”

Besides the tax levy, the board approved the annual resolution for abating of taxes to pay debt service on the district’s general obligation fund utilizing sales tax revenue as an alternative revenue bond, approved board meeting dates and times for the 2024 calendar year, and approved employments and resignations.

New Hires:

· Emily Lewand—Paraprofessional

· Ashly McElroy—Paraprofessional

· Joeli Schaubert—Paraprofessional

· Tonya Pryor—Paraprofessional

· Jared Wimberly—Custodian

Resignation:

· Connie Scherrer—Paraprofessional