Both the Salem Grade and High School Boards voted to hold Truth in Taxation hearings at their December meetings that will allow for their tax levies to increase by over six percent.

The school districts are eligible for the increases because the Consumer Price Index increase for the past year was 5 percent and there has been substantial growth in assessed valuation and new construction.

Salem Grade School Superintendent Dr. Leslie Foppe says the just over 6.1-percent increase they will seek will allow an additional $30,859 to be captured over limiting its tax levy to 4.99 percent to avoid the truth in taxation hearing. She notes since the increase cannot be captured in future years, the loss will accumulate to $308,000 over ten years.

While the audit presented earlier in the meeting showed the district with $ 9.4 million currently in the bank, Foppe says about half that amount is COVID relief money that has to be spent down by next year. She notes overall, there was a deficit in the district’s budget during the past year.

“We are still over $300,000 in the red in the Ed Fund this year. We are paying more for Transportation to have a very safe and wonderful group to work with in Robinson which is more expensive. There is more money that can be allocated there as well.”

Foppe says just looking at the property tax for the school district, the actual tax bill on a home could still decrease if not impacted by increased valuation.

The Salem Grade School Board will hold its truth in taxation hearing at six pm on December 18th at the start of its next regular meeting.

At Salem Community High School, a Truth in Taxation hearing will be held for an increase in the tax levy of up to 6.75 percent. Superintendent Dr. Brad Detering says the assessed valuation in the district is up $ 32 million dollars.

“Increase property values and the new property and CPI it still is going to allow for the tax rate to come down but that doesn’t necessarily take into account new construction, inflation and property value.”

Detering notes if they capped their levy at 4.99 percent to avoid the truth in taxation hearing the district would lose $61,530. He equates that to the cost of one teacher and benefits, but notes the loss will compound in future years because the money cannot be captured in the future.

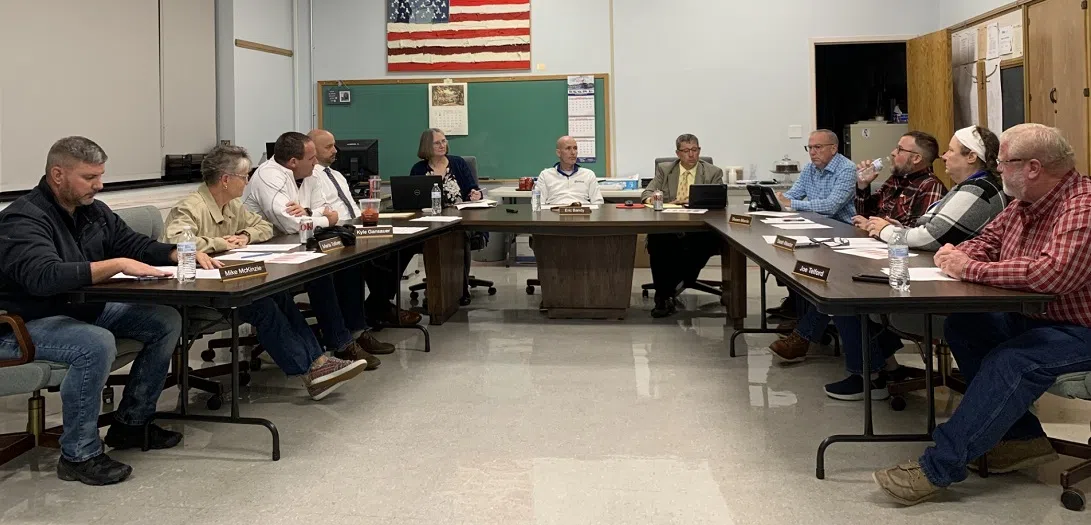

Board member Joe Telford voted against holding the truth in taxation hearing.

Salem Community High School will hold its Truth in Taxation hearing before its Monday, December 18th meeting at seven pm.